West Texas Intermediate (WTI) Crude Oil extended its losing streak for the third consecutive day on Friday, surrendering all the gains recorded earlier in the week. At the time of writing, WTI is trading near $62.35 per barrel, down almost 1.30% on the day, signaling continued bearish pressure on the US benchmark.

This retreat comes despite the Federal Reserve’s (Fed) recent 25-basis-point interest rate cut, reflecting a complex interplay of a strong US Dollar (USD), soft fuel demand, and persistent market uncertainty. Readers will find a complete breakdown of the issue from Elias Claude at LFtrade in this article.

US Dollar Strength Dampens Crude Prices

A firmer US Dollar has emerged as a significant headwind for WTI. As the USD strengthens, oil priced in dollars becomes more expensive for holders of other currencies, weighing on global demand. Traders are closely monitoring the DXY index, which measures the dollar against a basket of major currencies. The dollar’s resilience is amplifying downward pressure on WTI, limiting the effectiveness of positive catalysts such as the Fed’s easing.

Fed Rate Cut Fails to Lift Crude

Earlier this week, the Federal Reserve cut interest rates by 25 basis points, aiming to stimulate economic activity and, by extension, energy demand. While lower borrowing costs typically support crude prices by boosting consumption and industrial activity, this time the market reaction has been muted.

Analysts note that the rate cut was largely priced in, and ongoing concerns about weak fuel consumption in the US are overshadowing the potential boost from monetary easing.

Investors remain cautious, factoring in slowing economic growth, high inventory levels, and global oversupply risks. The Fed’s move, while generally bullish for risk assets, has failed to overcome the immediate pressure from USD strength and demand uncertainty in the energy sector.

Demand Concerns in the US

US fuel consumption data indicates softening demand, particularly in gasoline and diesel markets. Refiners’ throughput has slowed, reflecting both seasonal trends and a cautious consumer base amid rising borrowing costs and inflationary pressures. Weak domestic demand is compounding the impact of international dynamics, leaving WTI vulnerable despite temporary technical support levels.

Market participants are also monitoring inventories reported by the Energy Information Administration (EIA). Elevated crude stockpiles contribute to a bearish sentiment, reinforcing the recent downward trajectory in WTI.

Geopolitical Developments Add Complexity

On the geopolitical front, the European Union (EU) unveiled its 19th package of sanctions against Russia, which includes a proposed ban on Russian liquefied natural gas (LNG) imports from January 2027 and tighter restrictions on Moscow’s shadow fleet of tankers.

While these measures are expected to affect global energy supply in the medium term, their immediate impact on WTI remains limited. Traders are balancing geopolitical risk against near-term demand weakness and USD strength, creating a cautious trading environment.

WTI Crude Oil Price Today Faces Pressure Amid USD Strength and Demand Concerns

The WTI crude oil price today continues to struggle as traders weigh a strong US Dollar against soft domestic and global demand. Despite recent Federal Reserve rate cuts, WTI remains confined within a narrow trading range, reflecting cautious market sentiment. Analysts highlight that sustained weak fuel consumption in the US, coupled with elevated crude inventories, is limiting upside potential.

Technical indicators, including the 100-day SMA and RSI near 45, suggest that unless buying momentum returns, WTI is likely to test key support levels around $61.50, maintaining a bearish bias in the near term.

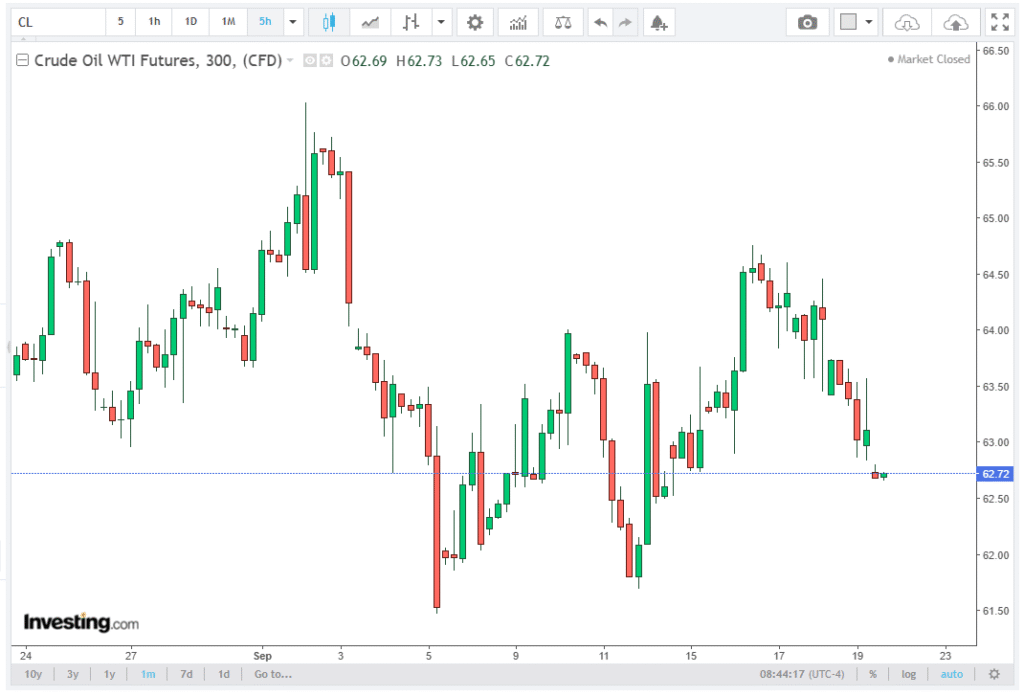

Technical Outlook: Narrow Range and Weak Momentum

From a technical analysis perspective, WTI is consolidating in a tight range, with resistance at $64.30 (100-day simple moving average (SMA)) and support at $61.50, a level that has held since early August. The repeated rejections at the 100-day SMA underscore its significance as a strong resistance zone, while $61.50 continues to act as a key floor in the near term.

The Relative Strength Index (RSI), currently hovering around 45, points to weak momentum and a lack of strong buying interest. Until the RSI climbs above 50 and price action breaks above the 100-day SMA, the market structure remains sideways to bearish, with downside risks likely to dominate.

A decisive break below $61.50 would open the door to $60.00 support, potentially triggering further technical selling. Conversely, a break above $64.30 could signal a shift toward bullish consolidation, attracting short-term momentum traders and reversing the recent losses.

Conclusion: Bearish Bias Prevails

WTI’s third consecutive day of losses highlights the delicate balance between monetary policy, currency strength, and crude demand. Despite the Fed’s rate cut, the strong USD and soft US fuel consumption continue to weigh on prices. Technical indicators reinforce a neutral-to-bearish outlook, with WTI trapped between $61.50 support and $64.30 resistance.