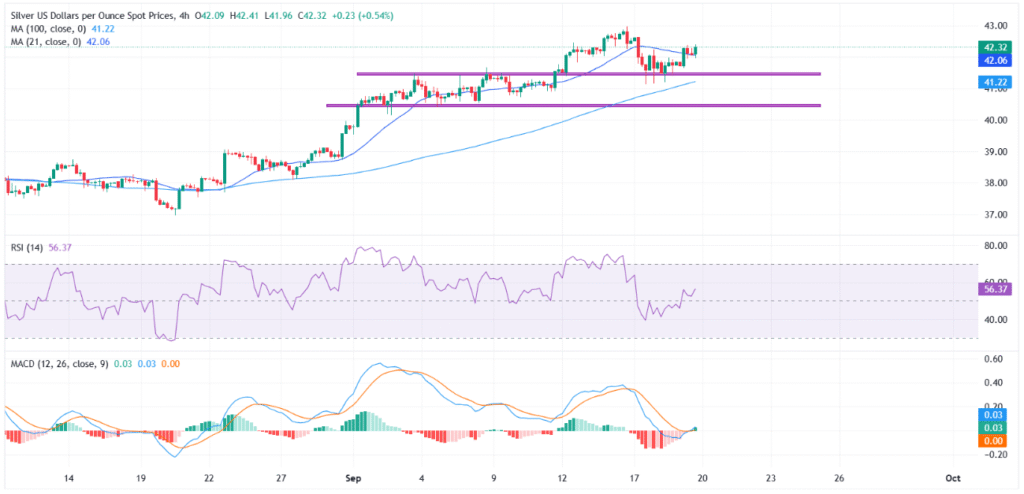

Silver (XAG/USD) extended its recovery on Friday, building on Thursday’s rebound after testing key support near the $41.50 level. The white metal is currently trading around $42.35, indicating that buyers are regaining momentum after a pullback from the 14-year high at $42.97.

Technical indicators suggest that momentum remains constructive, with upside potential still intact, provided $41.50 continues to act as a reliable support floor. The brokers at LFtrade, led by Natalie Jones, present a thoughtful and comprehensive overview of the matter.

Key Support Levels

On the 4-hour chart, the $41.50 area, a previous breakout zone, has emerged as a critical support level. Multiple lower wicks in recent candles indicate strong dip-buying interest, highlighting the market’s willingness to defend this level.

Silver is also holding above the 21-period Simple Moving Average (SMA) at $42.06 and the 100-period SMA at $41.22, which reinforces the near-term bullish bias. A decisive break below $41.50 could open the door for a deeper correction toward $40.50, exposing the base of the recent consolidation range.

Traders should monitor volume activity near these support zones, as increasing buying pressure around $41.50 may signal a resumption of the broader uptrend.

Resistance Levels and Upside Potential

On the upside, resistance remains layered. The immediate hurdle sits at $42.50, followed closely by the 14-year high at $42.97. A sustained breakout above $42.97 could pave the way toward the psychological $43.50 handle, potentially extending the broader bullish trend.

Short-term price action suggests a consolidation phase with an upward tilt, meaning traders should anticipate choppy but constructive moves as buyers attempt to reclaim higher ground. The ability of XAG/USD to hold above key SMA levels and support floors will be essential in confirming the strength of the recovery.

Momentum Indicators Signal Strength

Momentum signals are increasingly supportive of bullish prospects. The Relative Strength Index (RSI) has rebounded to 57, indicating strengthening momentum without entering overbought territory. This implies that further gains are possible before the market encounters technical resistance from overextended conditions.

Meanwhile, the MACD histogram is turning positive, with a potential bullish crossover developing. This combination of RSI recovery and MACD positivity suggests that buyers are regaining control, reinforcing the uptrend potential.

For traders, a failure to breach $41.50 could trigger a temporary retracement, but as long as this support holds, the upside bias remains intact, supported by technical momentum indicators.

Broader Market Context

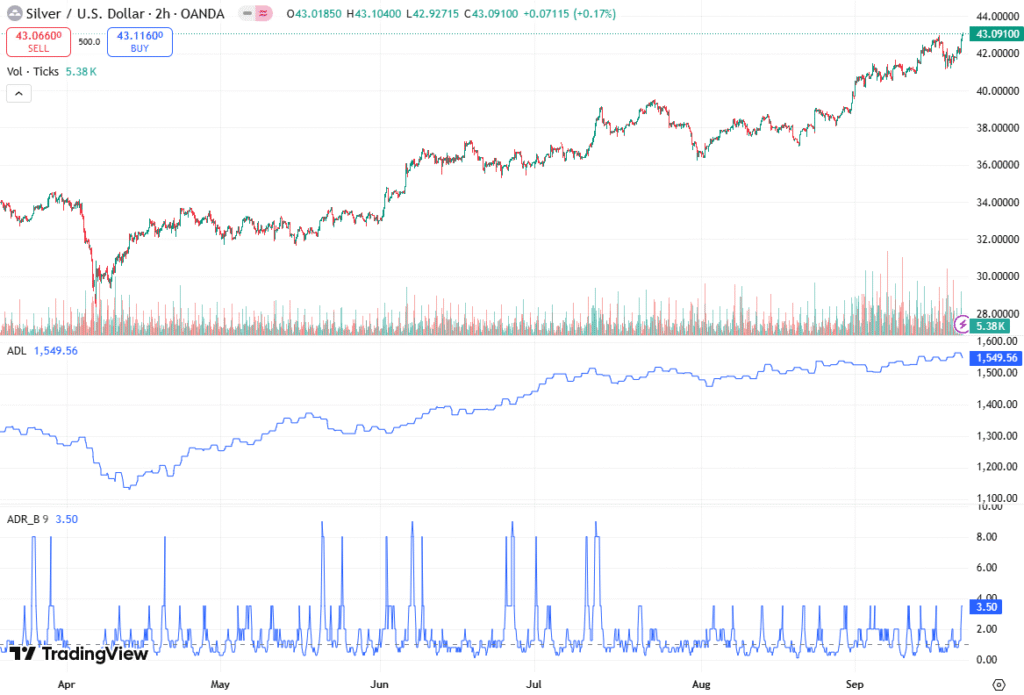

Silver’s recovery above $41.50 comes amid broader metals market optimism, with investors responding to inflation data, interest rate expectations, and safe-haven demand. The metal’s sensitivity to USD movements further emphasizes the importance of macro factors in guiding near-term price action.

As XAG/USD stabilizes above support levels, traders are likely to focus on upside targets while remaining cautious of potential corrections. A sustained move above $42.97 would mark a significant milestone, signaling resumed long-term bullish trends and reinforcing technical strength.

Silver Price Outlook: XAG/USD Eyes Key Technical Milestones

Looking ahead, the Silver price outlook remains constructive as XAG/USD attempts to consolidate above $41.50 support. Technical analysis suggests that a break above $42.97 could trigger a resurgence toward $43.50, reaffirming the long-term bullish trend.

Traders should monitor intraday price swings and volume surges near resistance levels, as these often signal potential breakout opportunities. Additionally, staying above the 21-period and 100-period SMAs will be crucial for sustaining upward momentum in the near term.

XAG/USD Momentum Analysis: Indicators Signal Bullish Continuation

Momentum analysis for XAG/USD shows growing bullish strength, with the RSI at 57 confirming healthy upside momentum and the MACD turning positive, indicating a likely bullish crossover. These signals suggest that Silver recovery could continue as long as the $41.50 support floor holds firm.

Traders and investors should watch for trend confirmations and breakout signals above $42.50 to capitalize on short-term gains while aligning with the broader positive trajectory of the metal.

Conclusion

In summary, Silver (XAG/USD) has demonstrated a constructive recovery after testing $41.50 support. Key technical levels, including the 21-period SMA at $42.06 and 100-period SMA at $41.22, continue to hold, providing a foundation for further gains.

Momentum indicators like the RSI at 57 and the MACD turning positive support upside potential, with resistance levels at $42.50, $42.97, and $43.50 representing key profit-taking or breakout zones.

As long as $41.50 holds, the bullish outlook remains intact, with opportunities for short-term traders and long-term investors to capitalize on XAG/USD’s momentum recovery. Market participants should remain vigilant of price action near critical support and resistance levels, ensuring trades align with technical momentum and broader market trends.