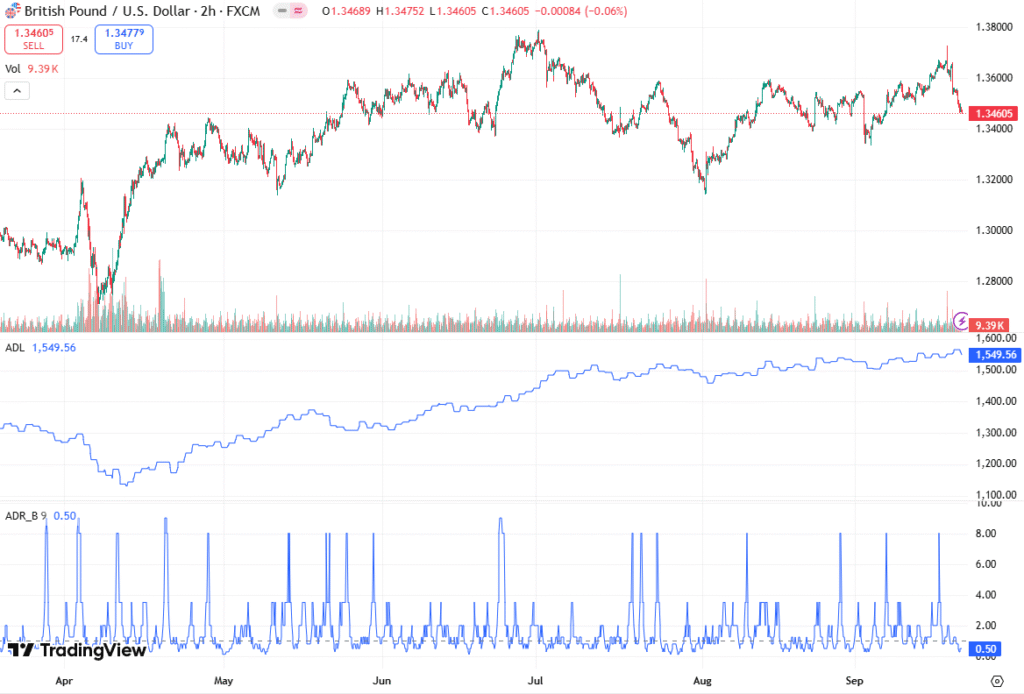

The British Pound (GBP) dropped significantly against the US Dollar (USD) on Friday, with GBP/USD slipping beneath 1.3480, as the ‘King Dollar‘ strengthened after the Federal Reserve’s (Fed) monetary policy announcement earlier this week.

Despite positive UK Retail Sales, Sterling struggled to hold gains amid lingering fiscal concerns and broad USD strength, leaving investors cautious ahead of next week’s economic calendar. Nadeen Donovan of LFtrade simplifies the complexities of the topic in this detailed piece.

GBP/USD Struggles Despite Positive UK Retail Sales

The GBP/USD currency pair slipped to 1.3482, marking a 0.52% decline on Friday, even as the UK Retail Sales data for August exceeded expectations. Retail Sales rose 0.5% month-on-month (MoM), above forecasts of 0.4%, signaling some resilience in UK consumer spending. However, the upside for Sterling was limited by ongoing worries about Britain’s fiscal position and rising government debt, which continue to weigh on GBP sentiment.

While economic fundamentals showed strength in the UK, the broader market mood favored the US Dollar, which has bounced back from three-year lows following the Fed’s 25 basis points (bps) rate cut. Traders have highlighted that Sterling remains vulnerable in the face of a strong Greenback, particularly as the US Dollar Index (DXY) stabilizes around 97.60, consolidating gains from earlier in the week.

US Dollar Recovers as Fed Cuts Rates

The US Dollar regained footing after the Fed decided to reduce interest rates by 25 bps, a move widely anticipated by the market. The DXY, which tracks the USD against a basket of six major currencies, rallied sharply post-Fed before leveling near 97.62. This rebound underscores the Dollar’s status as the world’s reserve currency and its continued appeal amid global economic uncertainty.

Minnesota Fed President Neel Kashkari commented on the rate cut, supporting the move due to risks of rising unemployment. He noted that inflation is unlikely to exceed 3% despite tariffs and added that future rate hikes could occur if economic conditions warrant. Such statements contribute to market volatility and have reinforced the Dollar’s safe-haven appeal, putting additional pressure on GBP/USD.

Fiscal Concerns Cap Sterling Gains

Despite robust UK Retail Sales, the British Pound remains under pressure from both domestic and international factors. Investors are increasingly cautious due to UK fiscal challenges, including public debt levels and concerns about government spending policies. This has limited Sterling’s ability to benefit from positive economic data, leaving GBP/USD vulnerable in the current risk-off environment.

Analysts note that fiscal uncertainty, combined with Dollar strength, could keep the GBP/USD pair below 1.3500 for the short term. The market is also closely watching UK monetary policy signals from Bank of England (BoE) officials, which could influence Sterling’s near-term trajectory.

Eyes on US Economic Data and Fed Speakers

Next week, the US economic docket will feature several key indicators, including S&P Global Flash PMIs, Durable Goods Orders, Jobless Claims, and GDP data, as well as the Core PCE Price Index, the Fed’s preferred measure of inflation. In addition, a series of Fed officials will deliver speeches, offering insights into future monetary policy, which could influence USD momentum and consequently, GBP/USD.

Across the Atlantic, the UK economic calendar will also see activity, with Flash PMIs and BoE policymakers expected to share updates. However, given the current strength of the Dollar, Sterling may struggle to capitalize on domestic improvements in the near term. Traders will likely focus on cross-market correlations and risk sentiment, as GBP/USD volatility remains elevated amid post-Fed adjustments.

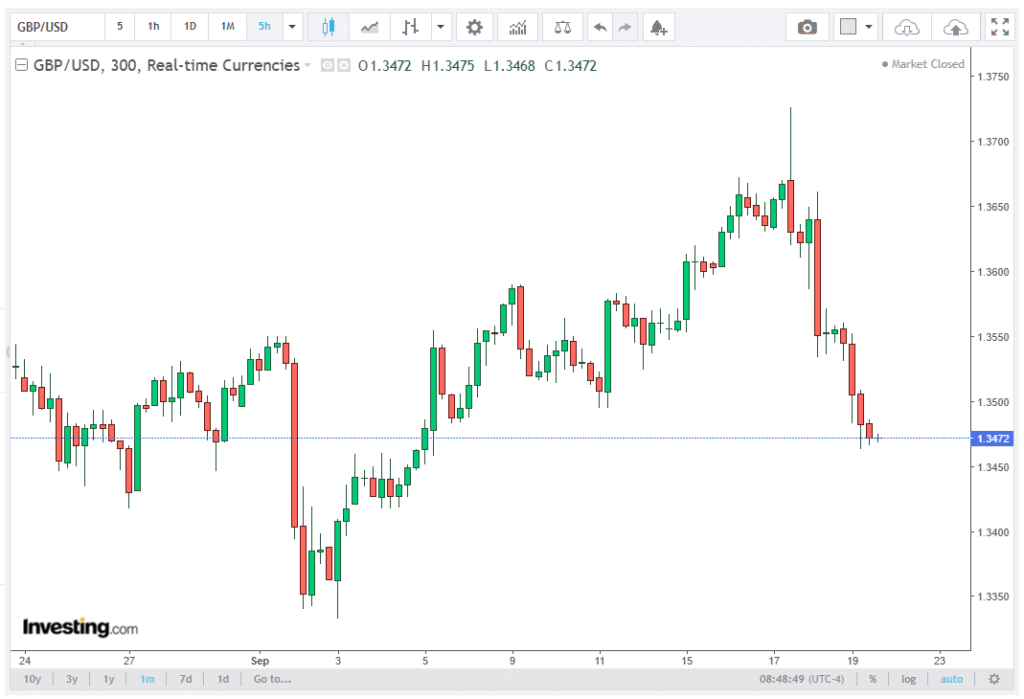

Technical Outlook for GBP/USD

From a technical perspective, GBP/USD faces immediate resistance near 1.3500, while support levels are observed around 1.3450. Momentum indicators suggest that Sterling remains in a bearish phase, largely due to the rebound in the USD and fiscal uncertainties. Any upside attempts are likely to be capped unless market sentiment shifts in favor of risk-on assets or the BoE signals a more aggressive monetary stance.

Traders should also be mindful of quad witching effects, which could exacerbate price swings, and monitor key US releases for potential triggers that may influence the GBP/USD trend. Overall, Sterling faces a challenging environment, with the ‘King Dollar’ asserting dominance in the forex landscape.

Conclusion

In summary, GBP/USD trades below 1.3500, pressured by a resurgent US Dollar and UK fiscal concerns, despite better-than-expected Retail Sales. With quad witching adding volatility risks and a slew of US and UK economic releases ahead, traders should brace for a potentially turbulent session in the FX market. The interplay between monetary policy signals, economic data, and market sentiment will remain key drivers for the Sterling-Dollar pair in the near term.